MLA

/ MAPR & Payment Obligation Disclosure

and Online MAPR Calculator for Financial Institutions |

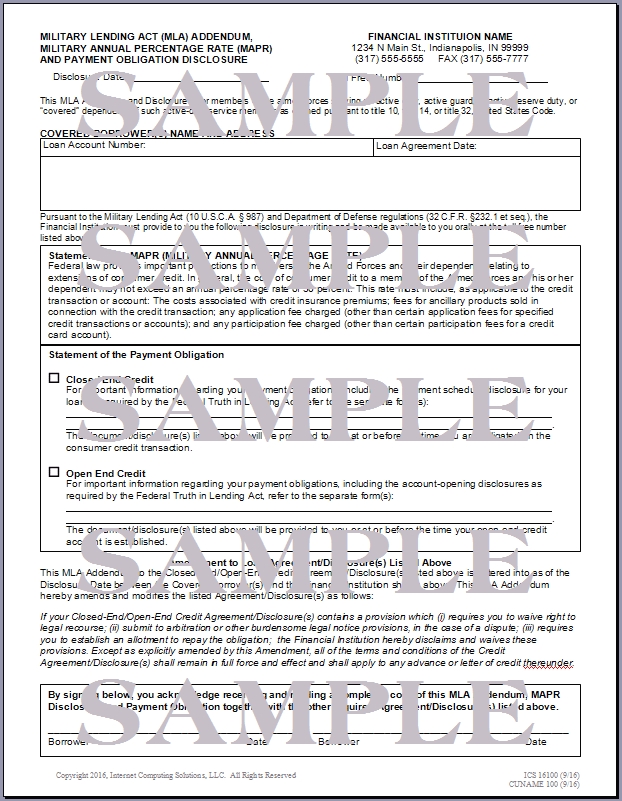

Wondering how you can become compliant with the Military Lending Act (the MLA) / MAPR requirements? We Can Help. We are offering an MLA / MAPR and Payment Obligation Disclosure Addendum and an online MAPR Calculator for any Financial Institution, Lending Institution, or Auto Dealer that needs an addendum form to their Loan Notes & Disclosures to be compliant with the Military Lending Act MLA / MAPR requirement. We also have available an Online Military Anual Percentage Rate (MAPR) Calculator that will easily calculate the MAPR for you given the loan parameters. NOTICE: There has been a new Advisory update that was released in December that directly affected Auto Dealerships, especially Buy Here Pay Here Dealerships, and those that participate in indirect lending with financial institutions. You are required to provide the same disclosures to your customers, "covered borrowers", that financial instituions are required to provide. If you have recently received a letter from your auto financing institutions, it should have contained a letter referring to this advisory. If you're visiting here from a Car or Truck Dealership "we can help" you become compliant. Give us a call or send us an email today.

This Disclosure form is available for any Financial Institution or Lending Institution for an initial $60 setup fee and $120 per year license fee. The first year cost would be $180 and $120 per year for licensing of the form thereafter. Call us today... "We Can Help".

To be integrated to the Financial or Lending Institution's data processing system you would have to contract with your DP or IT services to create the interface to the calculator. This is accomplished by simply making a call to the calculator via a simple URL request. Upon receiving the URL request the calculator will verify the Financial or Lending Institution via their IP address and then display the results at which time the user would be able to print the results. For manual calculations the subscribed Financial or Lending Institution needs to just visit the website using their subscribed URL and enter in the required parameters and fees manually and click the Calc MAPR button to display the results. We are offering access to the MAPR Calculator and Results Report for an initial $60 setup and $120 per year license fee. The first year cost would be $180 and $120 per year thereafter.

For Open-End Loans the report will list the payment schedule as provided and determine if at any time during the payment schedule the MAPR may exceed the 36% limitation and flag that appropriately. For example: if the Financial Institution charges an Annual Fee while the account is opened or charges a withdrawl fee for an advance (not a participation fee), that fee as assessed in that payment period may cause the MAPR to exceed the 36% limit. Our MAPR Calculator Results will show that on the report and suggest to the financial institution that either the fee needs to be waived or reduced. NOTE: If you elect to have access to both the Calculator along with the Results Report, and the MLA / MAPR and Payment Obligation Disclosure form we will provide a discount of 25%. The setup fee would be $90 and the annual cost would be $180 per year. That would be $270 in the first year and $180 per year thereafter. Contact Info: If you have ANY questions about our service, please contact us at mlamapr @ mlamapr.com and/or call us at 317-886-8528 or toll-free at 888-886-8528. We're here to help. Here are some facts regarding the MLA / MAPR. Here

are some Helpful Links for you to use to learn more about

the MLA/MAPR regulations. |

The Military Lending Act - MLA / Military Annual Percentage Rate - MAPR service is provided without warranty by Internet Computing Solutions, LLC., located in Greenwood, IN, 46143, 317-886-8528, toll-free: 855-411-8528, fax-free: 866-571-0372 |

| © 2018 Internet Computing Solutions, LLC, All RIghts Reserved. |

Our

MAPR & Payment Obligation Disclosure form will provide

the necessary disclosure information for your customers,

pursuant to the Military Lending Act (10 U.S.C.A. § 987)

and Department of Defense regulations (32 C.F.R. §232.1

et seq.). We can provide this form to you in nearly any

format that you need for your Data Processing System

or (LOS) Loan Origination System to be able to print

the necessary customer data on the form.

Our

MAPR & Payment Obligation Disclosure form will provide

the necessary disclosure information for your customers,

pursuant to the Military Lending Act (10 U.S.C.A. § 987)

and Department of Defense regulations (32 C.F.R. §232.1

et seq.). We can provide this form to you in nearly any

format that you need for your Data Processing System

or (LOS) Loan Origination System to be able to print

the necessary customer data on the form.  The

MLA / MAPR Calculator can only be used by Financial or

Lending Institutions that subscribe to our service. We

have implemented an IP based security that checks the

IP address of the end-user to ensure that it matches

up with the subscribed Financial or Lending Institution.

This calculator can be used manually or automated with

a Financial or Lending Institutions data processing system.

The

MLA / MAPR Calculator can only be used by Financial or

Lending Institutions that subscribe to our service. We

have implemented an IP based security that checks the

IP address of the end-user to ensure that it matches

up with the subscribed Financial or Lending Institution.

This calculator can be used manually or automated with

a Financial or Lending Institutions data processing system.  We

understand that the Regulations do not require to the

institution to provide the calculated results to the

member(customer) but they have to have some means of

calculating the MAPR at the time of the loan closure

for closed-end credit and every billing cycle for open-end

accounts. Based on this understanding, it would be best

practice for the Financial or Lending Institution's to

have a printed report at the time of the loan/account

inception as part of the Financial or Lending Institution's

loan documents for auditing.

We

understand that the Regulations do not require to the

institution to provide the calculated results to the

member(customer) but they have to have some means of

calculating the MAPR at the time of the loan closure

for closed-end credit and every billing cycle for open-end

accounts. Based on this understanding, it would be best

practice for the Financial or Lending Institution's to

have a printed report at the time of the loan/account

inception as part of the Financial or Lending Institution's

loan documents for auditing.